Insights & Analysis

Why Are Corporate Formalities Important?

Corporate formalities may seem like just paperwork, but they are fundamental to a business’s legal health and longevity. From keeping personal liability separate to ensuring compliance, corporate formalities protect your business and support sustainable growth. Explore why maintaining formalities like meeting minutes, bylaws, and proper records is essential for any incorporated entity.

At a Glance: Gross-Up Provisions in Leases

Gross-up provisions are a common element in commercial leases, ensuring fair allocation of operating expenses when a building is not fully occupied. These provisions allow landlords to "gross up" expenses to reflect full occupancy, protecting them from losses while providing tenants with transparency on costs. This article explores the mechanics of gross-up provisions, their importance, and how they impact both landlords and tenants. Whether you’re drafting or reviewing a lease, understanding these provisions is crucial for safeguarding your interests.

Does My Company Need a Shareholder Agreement?

A shareholder agreement is a critical legal document that outlines the rights, obligations, and protections for a company's shareholders. Whether you're starting a new business or already have an established company, a well-drafted shareholder agreement can help prevent conflicts, safeguard investments, and ensure business continuity. In this article, we explore why your company might need a shareholder agreement, its essential components, and the potential risks of not having one in place.

What Is a Charging Order?

A charging order is a powerful legal tool that protects LLC owners from creditors by limiting the creditor's access to the debtor's membership interest. In this article, we explain how charging orders work, their benefits for asset protection, and what LLC owners need to know when facing creditor claims.

How to Prepare Your Business for an Economic Slowdown

Economic slowdowns can create challenges for businesses of all sizes. However, with the right preparation, your business can remain resilient and even thrive. This article explores essential steps such as managing cash flow, reducing non-critical expenses, and maintaining customer relationships to ensure your business is ready for economic downturns.

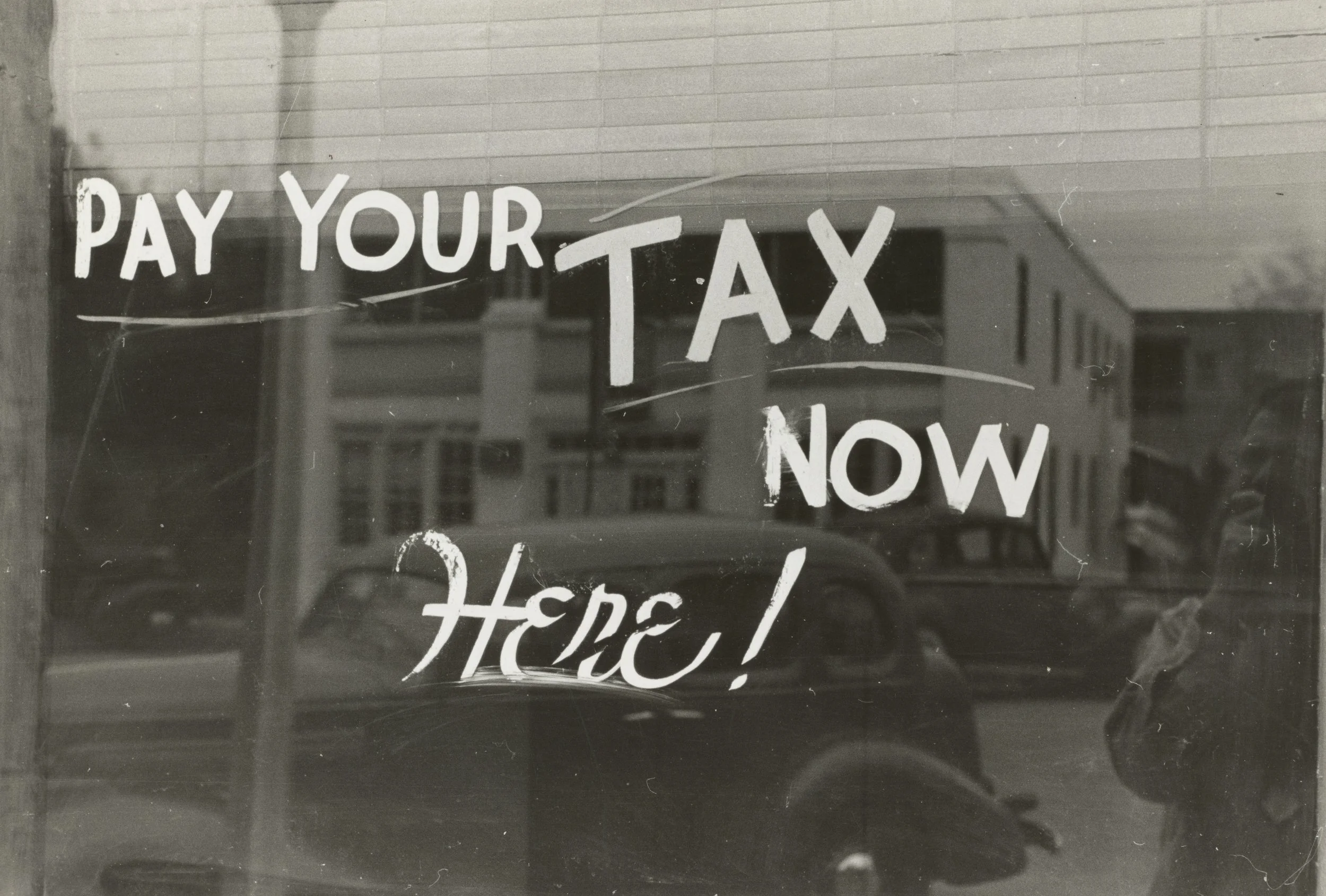

Tax Deductions for Home-Based Businesses

Home-based business owners can benefit from a range of tax deductions. Learn the basics of what you can claim, from home office expenses to internet costs, in this short, informative guide.

Considerations for Forming a Limited Liability Company for Real Estate

Forming an LLC for real estate offers liability protection, tax advantages, and management flexibility. This article covers the critical considerations to help you decide if an LLC structure is the right fit for your property investments.

Should You Convert Your Sole Proprietorship to an LLC?

Converting your sole proprietorship to an LLC offers significant benefits, such as personal liability protection, potential tax savings, and enhanced professional credibility. However, it's important to weigh the costs, administrative responsibilities, and your business goals before making the decision. In this article, we break down the key considerations to help you determine if an LLC is the right move for your business.